Streamline compliance with automated regulatory reporting

Enhance accuracy in meeting regulatory requirements, minimise manual effort, and respond swiftly to ad-hoc requests with customisable reporting.

The Challenge

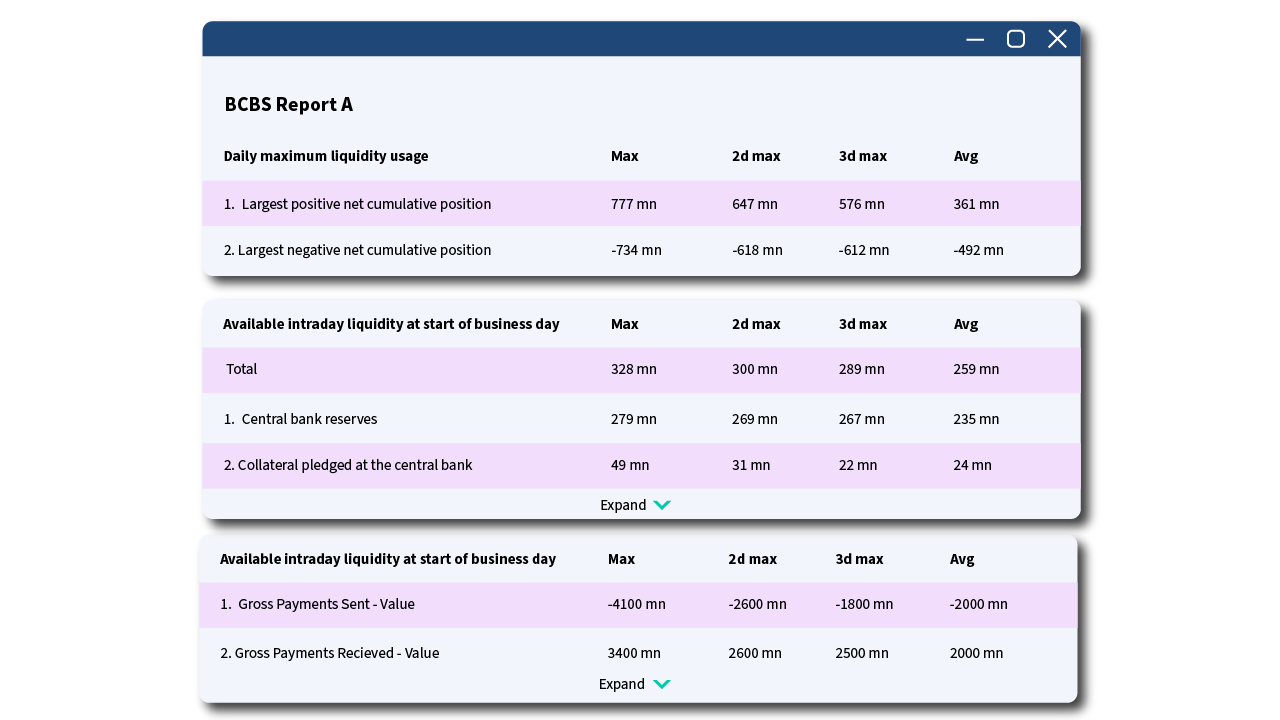

Meeting regulatory requirements such as BCBS248, as well as responding to ad-hoc liquidity reporting requests, presents significant challenges.

Completing intraday liquidity metrics often requires extensive manual effort. Additionally, the data needed for these reports is not easily accessible, making it difficult to respond to requests, especially when regulators like the ECB demand liquidity metrics at short notice and with high frequency.

The Solution

Realiti offers out-of-the-box BCBS248, which can be easily edited to meet specific supervisory requirements for key reporting metrics. It provides an open, near real-time copy of the data, enabling banks to create custom reports as needed.

By combining automated standard reporting and custom reporting, Realiti:

- Reduces manual effort

- Ensures timely and accurate regulatory submissions

- Enhances the bank’s ability to fulfill complex and frequent regulatory requests efficiently