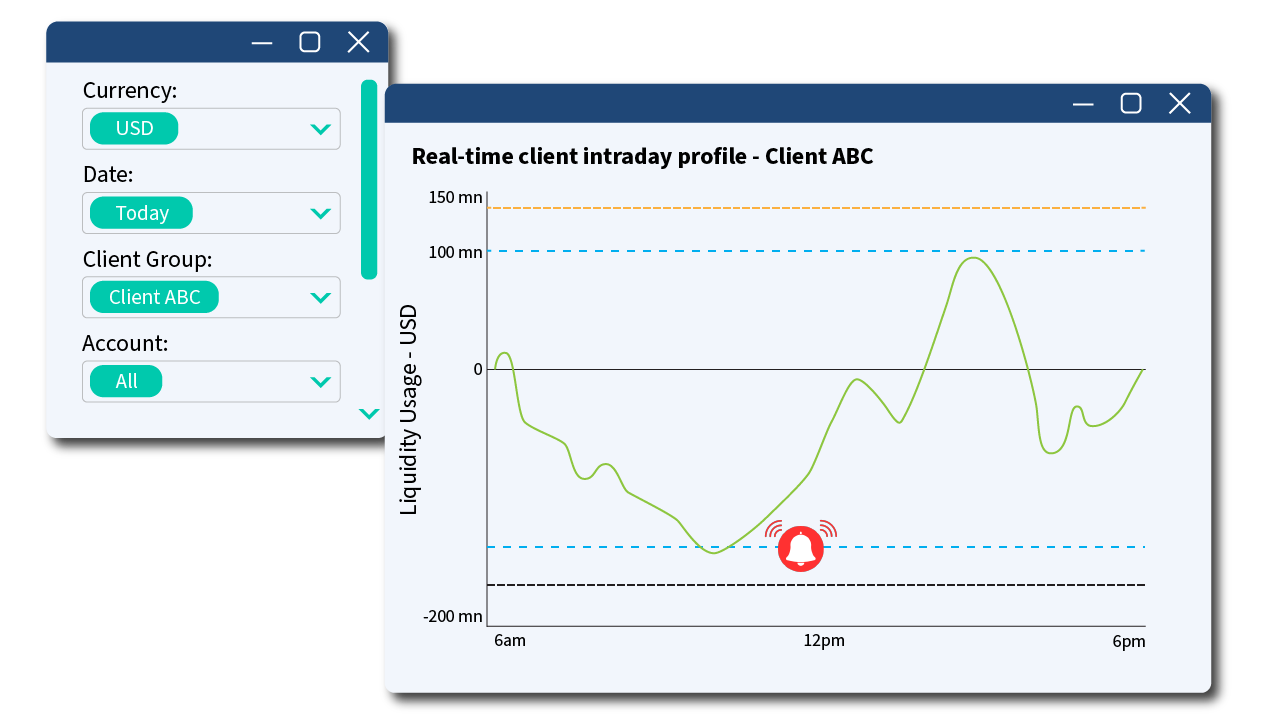

See client intraday liquidity usage

Gain insights into client account behaviors, identify unusual settlement patterns, optimise resource allocation, and improve decision-making.

The Challenge

Treasury departments face significant challenges in managing client accounts, particularly when monitoring the liquidity usage of financial institutions and large corporates. Identifying unusual settlement patterns, which can affect a bank’s own liquidity and funding needs, becomes a complex task due to the sheer number of client bank accounts to oversee.

A lack of automated systems can exacerbate this difficulty, as manual processes often lead to inefficient monitoring, increased resource demands, and a higher risk of errors.

The Solution

Realiti’s clever liquidity management system can alleviate these issues by providing real-time data, allowing for the prompt identification of exceptional activities, and supporting cost recovery and regulatory compliance. This technology means your bank gains:

- Insights into client intraday balances at both aggregate and granular levels

- The ability to set alerts to enables the identification of exceptional activities

- Detailed and timely information, which enhances the bank’s understanding of client behavior and credit risk

Banks that have this capability are making more informed decisions and responding proactively to potential issues.