This time last year I wrote an intraday liquidity article looking back at 2022 and forward to 2023. It got a good response so I’ve decided to provide some similar thoughts at the start of 2024. It turns out that there’s a lot to say! So the TL;DR summary is:

- Firms have always needed to nail intraday for lots of good reasons – risk, regulatory and also due to the massive financial implications

- 2023 saw lots of things that impact the world of intraday – interest rates still high; everything becoming faster and even more real-time; all sorts of things happening in the wider world to generate instability; new products/innovations being introduced to create new markets and infrastructures for trading intraday liquidity

- The March Madness that saw banks wobble/collapse was the biggie and we are already seeing (and expect to see more) interest from regulators in both intraday liquidity and in testing whether banks can respond in real time when things start to get a little crazy.

Real-time intraday liquidity: the what and the why

For the remainder of this article I’ll keep the focus on intraday liquidity but note the overlap between the words intraday and real time. When it comes to liquidity we sometimes use the words interchangeably. As a simple way of understanding the terminology remember it’s important to understand your liquidity at a granular intraday level and it’s much better to do that in real time (rather than after the event) so you can address an intraday problem in real-time, before it’s too late.

Now, as a reminder, there are lots of reasons for a firm to be on top of its intraday liquidity challenges and have insight available in real time. A few examples include:

- Intraday insight helps you minimise the size of your intraday liquidity usage i.e. your daylight overdraft. Good news if you are paying interest on such an overdraft or paying for the privilege of running a credit line. Even better news if this means you can reduce the size of your intraday liquidity buffer as these can have annual costs of $tens of billions to service.

- If you know what’s happening right now on all the accounts you care about then you can manage risks as they crystallise (are you owed money by that counterparty that could be the next bank on the verge of collapsing? Has that large inflow you are expecting actually happened yet or do you need to move liquidity around to prevent an expensive overnight overdraft?)

If you want a quick overview of how to think about and ultimately control intraday liquidity then Baringa recently wrote a snappy piece that’s worth a look.

Four big topics from 2023

In the rest of this article I call out a number of 2023 topics that impact intraday liquidity and are worthy of discussion. Of most interest, and hence I cover in the most detail, are the banking collapses we saw in March 2023 and how the regulators are/will be responding to these events. But before we dive into March Madness I’ve got four other topics to mention in brief:

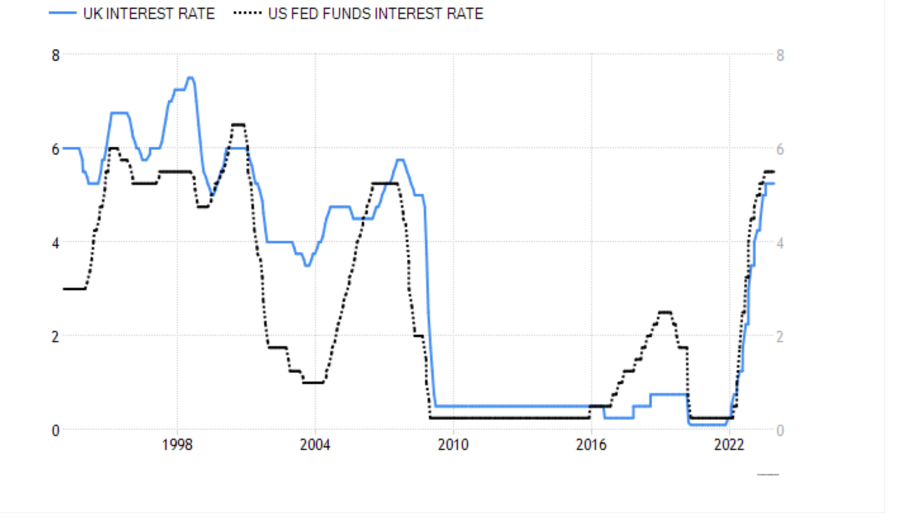

Interest rates are still high

Rates are much higher than the ‘norm’ that many people have got used to. The chart below shows US and UK interest rates over the 30 years or so than a 50-something like me has been working in the corporate world. Today’s interest rates don’t seem too crazy to me, but if you had entered senior positions after 2008 then current rates look astronomical and the associated costs of funding and liquidity are much higher than what you have been used to. Since liquidity costs you more than ‘usual’ you had best use it wisely.

Real-time is increasingly important.

It is becoming much easier for anyone to move money in real-time hence bank treasuries need to be able to monitor, manage and deploy their liquidity in real time. This will require building the infrastructure, capabilities and processes that real-time treasury demands.

The world is a volatile place

Combine the real-time speed of liquidity movement with increased volatility in world events. Such volatility will require banks to be nimble as the world moves around them, liquidity issues burst out in unexpected places and treasurers need to respond swiftly. Key examples of this volatility include:

- 2023 saw the continuation of the war in Ukraine and the knock-on effects across international relationships and domestic politics (think about the challenges of setting US federal budgets, the impact on relations with China as China gets close to Russia, the realignment of strategic international partnerships as new blocs of interest are formed).

- The Middle East is in new period of chaos with no real prospect of resolution on the horizon. Amongst many, many issues being felt by millions, as 2024 dawns we are seeing the potential impact on world trading routes which could have major negative impacts on the global economy.

- 2024 is the year of elections with around half the adult population of the globe able to vote in 2024 elections, including in eight of the 10 largest countries by population. In an era of increasing populism it is likely that we will see new leadership implementing policies very different from the stable norm.

New intraday products and solutions

The fourth topic comes from the increasing noise about intraday products and solutions being brought to market. When large banks bring out new products, and funders with deep pockets get behind new offerings, then you know something is afoot. This is because as firms get better at understanding and managing liquidity at an intraday level in real time, there is the opportunity to make money and/or save money from recycling liquidity intraday between firms. Here are three examples worth a deeper dive:

- BNY Mellon has brought out its triparty platform for intraday repo so they clearly think customers are looking to access/provide intraday liquidity

- Similarly JP Morgan now provide ‘Digital Financing’ on their Onyx blockchain platform, so you can exchange cash for collateral on an intraday basis. BNY’s and JPM’s ideas are ideal if you have an intraday hole to fill or an intraday excess you want to make some money on

- Finteum has made great strides in rolling out its new market infrastructure specifically targeted at enabling exchanges of liquidity for intraday periods

March Madness and wobbly banks

My final 2023 topic is the one I think is most meaningful for driving activity in the intraday world in 2024, which is the March Madness we saw in 2023. Here a range of banks failed and/or were taken over by their peers.

So what happened in March?

In the US the headline act was Silicon Valley Bank (SVB) which expired due to a good old-fashioned bank run i.e. the bank didn’t have enough liquidity when it needed it and it simply ran out of cash. This collapse was much faster than historical bank runs, powered by social media and the opportunity for customers to pull their money out in real time. Here is a comparison to make you wince – in the 2008 Icesave collapse, 20% of UK deposits left in 75 days, SVB lost 85% in 2 days! The finger of SVB blame was pointed squarely at management, who didn’t have the right risk culture and didn’t act on feedback from regulators. They continued to act as if they were still running a small bank and this caught up with them with devastating consequences.

Silicon Valley Bank (SVB) failed because of a textbook case of mismanagement by the bank. Its senior leadership failed to manage basic interest rate and liquidity risk. Its board of directors failed to oversee senior leadership and hold them accountable. And Federal Reserve supervisors failed to take forceful enough action.

As SVB went under, other mid-sized US banks melted under the increased spotlight, but the biggest story was the global systemically important bank Credit Suisse (CS). Credit Suisse was a much bigger and more complex beast than SVB but it had the same problem as it also ran out of available liquidity. CS had problems ever since the 2008 global financial crisis with a series of scandals and negative results, with a resulting loss of market confidence over many years. They had severe liquidity issues in summer 2022, with regulators in Europe and the US getting involved, and all parties spent a lot of time preparing for a potential resolution / strategic realignment. But when the US banks went under in March 2023, the market looked at CS and decided they were next, and a bank run really took hold. One key element was that CS’s LCR looked fine i.e. they appeared to have enough High Quality Liquid Assets (HQLA) to survive a bank run but, just like Lehmans before them, they were having to use this HQLA to plug intraday liquidity holes. Ultimately, they didn’t have the liquidity when they needed it most and the regulators were forced to act, with UBS ‘encouraged’ to take over the stricken CS empire.

What does all this mean?

The March Madness had some common themes. Ultimately banks fail when they don’t have liquidity in the right place at the right time. If you don’t have access to sufficient intraday liquidity to use when you need it during the day then you will not survive. A lack of market confidence in a bank puts pressure on the need for liquidity and its Treasury will have to act much more quickly given the real-time nature of customer decisions and withdrawals. This means bank management must have up-to-date information at its fingertips and be able to monitor liquidity and risk positions much more frequently. Senior management need to think about risk rather than short term profits and need to ensure they have the governance and processes in place to do this.

But when we consider what causes a bank to improve its capabilities, the harsh truth is that it is usually regulatory pressure that encourages a good idea to become a reality. So it’s worth us pondering on how regulators are interpreting the March Madness of 2023 and what their responses might be.

What are regulators thinking for 2024?

Let’s start with the view from the Bank for International Settlements (BIS) and its Basel Committee for Banking Supervision (BCBS). BCBS sets the standards for regulating the world’s banks, so it’s well worth a look. The BCBS Report on the 2023 banking turmoil is a speedy read that provides an overview of what happened, how supervisors should react and what this might all mean for future regulation. In here we find commentary on how the demise of Credit Suisse was directly related to the bank running out of intraday liquidity and how the US banks collapsed much more quickly than anticipated, hence having real-time insight and the ability to act intraday is vital.

It’s also worth taking a look at a key September 2023 speech from the Chair of the BCBS, which provides a punchy summary of BCBS thinking starting with liquidity and moving onto conclusions including that liquidity is moving faster than ever, banks’ risk processes aren’t fit for purpose, questioning if LCR is the right tool for the current world and hinting strongly that supervisors will need to be more challenging with their banks while regulators will need to consider new regulations.

“While each of the banks that failed during the turmoil had idiosyncratic features, they all ultimately succumbed as a result of significant liquidity outflows and an inability to maintain sufficient stable funding”

And this type of thinking is happening much more widely than just the refined atmosphere of Basel. The Financial Stability Board (which worries about how dying banks need to regenerate or expire gracefully) is reviewing its approaches in the light of March Madness. The Federal reserve has called out intraday liquidity as a priority area for inspection in 2024. The European Central Bank is discussing the limitations of the current LCR regime. In Switzerland, Finma’s new Liquidity Ordinance will see liquidity add-ons being used to address risks including LCR weaknesses and the need for ringfenced intraday liquidity buffers.

In conclusion, 2023 gave a bank lots of reasons to optimise its intraday liquidity capabilities and ensure it can operate a real-time treasury. Banks might anticipate some interesting discussions with their supervisors in 2024, who will be keen to find out how the bank will avoid the next Black Swan that comes their way. One key element of a bank’s response will be its capabilities to monitor and manage intraday liquidity in real-time. If you want to know what good looks like, please take a look at Realiti from Planixs or just drop me a message.